Is the sky falling for DexCom (NASDAQ: DXCM)? Shares of the medical device specialist dropped off a cliff following its second-quarter earnings report. Unfortunately, the diabetes-focused company failed to impress investors yet again with its most recent quarterly update.

At about $69 per share, DexCom’s stock isn’t that far off its 52-week low of $62.34 and is miles away from its 52-week high of $142. However, there remain good reasons to invest in the company.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Let’s first review what DexCom does. The company is a leader in the market for continuous glucose monitoring (CGM) systems, which allow diabetes patients to keep track of their blood glucose levels efficiently throughout the day and night. It recently launched the G7, one of the most advanced CGM systems.

However, the rollout of the G7 in the U.S. came with some complications related to rebate eligibility, with many more patients taking advantage of rebates than anticipated.

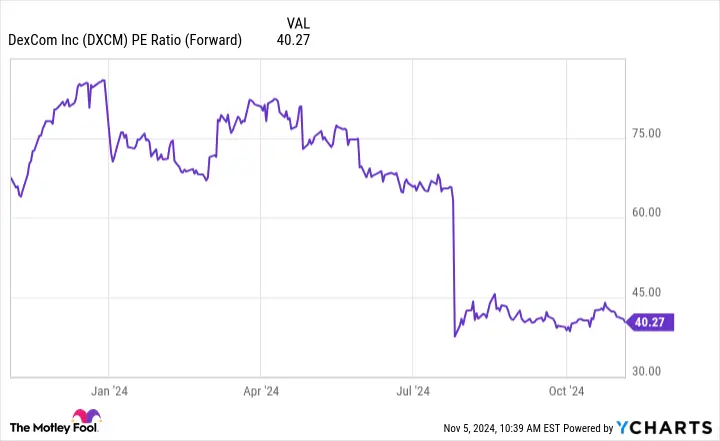

That was one of the issues during the second quarter, exacerbated by the company’s slowing growth in international markets. These issues carried into the third quarter, when revenue for the period increased by just 2% year over year to $994.2 million. Investors would expect a company with a forward price-to-earnings ratio (P/E) of about 40 to grow its revenue at a much better rate.

The average P/E for the healthcare industry is 18.2. And the company’s adjusted EPS of $0.45 was lower than the $0.50 reported in the year-ago period. There wasn’t much to celebrate in the quarterly update, but let’s consider why the company’s prospects remain attractive.

What do the headwinds DexCom has encountered lately mean for its investment thesis? As far as the rebate eligibility problem is concerned, it doesn’t mean much. That’s a short-term issue that won’t matter anymore in a couple of years.

Its slowing growth in international markets is more worrisome, but even then, it’s important to look at the bigger picture. The company has historically increased its addressable market by entering into new territories. It still has plenty of room to do so. As its biggest competitor in the CGM market, Abbott Laboratories, pointed out, only 1% of the world’s half-billion adults with diabetes have access to CGM technology.

Not all are eligible for it, but the ones who are make up more than 1%; this underpenetrated market could give DexCom significant growth potential beyond the next decade. It is still looking to expand worldwide.

Leave a Comment