Many sources of passive income require some level of activity, like managing a rental property or portfolio of stocks. Others are as passive as they come. You just sit back and watch the passive income flow into your account.

Exchange-traded funds (ETFs) offer a much more hands-off approach to generating passive income. One great option is the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ: JEPQ). The ETF offers a high-yielding monthly-income stream, making it ideal for those seeking passive income.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

JPMorgan Nasdaq Equity Premium ETF has a dual mandate. It seeks to deliver monthly-distributable income and exposure to the Nasdaq-100 index with less volatility.

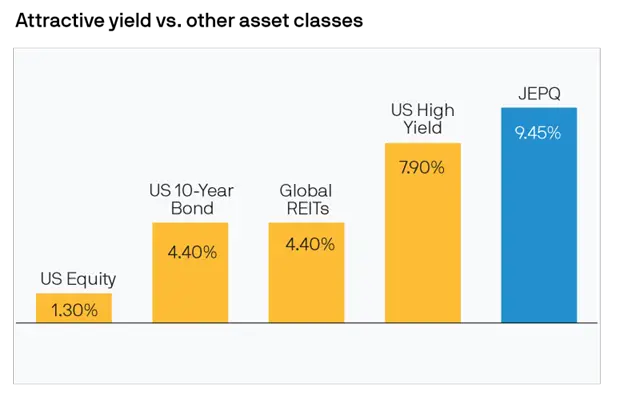

The fund has an interesting strategy to generate income for its investors. It writes out-of-the-money call options on the Nasdaq-100 index. This strategy generates options-premium income that the ETF distributes to its investors each month. Options writing can be a very lucrative income strategy. Over the last 12 months, the ETF has offered a dividend yield of 9.7%. Meanwhile, its yield in the past 30 days is nearly 9.5%. That’s a very attractive yield compared to other asset classes:

As that graphic shows, the fund’s yield over the past month is higher than high-yielding U.S. bonds (i.e., junk bonds). Its yield is also more than double that of other higher-yielding investment vehicles, like U.S. Treasury bonds and real estate investment trusts (REITs). It’s also a lot higher than the average stock.

However, it’s worth noting that the fund’s monthly payment can vary significantly:

That’s because the income it generates fluctuates based on volatility. The more volatile the market, the higher options premiums tend to be. So, as a seller of options, it can collect more premium income when volatility is higher. However, even in a low-volatility market, the ETF should still generate a lot of income because the Nasdaq-100 is a more volatile index than the S&P 500 due to its focus on growth stocks.

JPMorgan Nasdaq Equity Premium ETF offers more than just passive income. The fund also provides lower volatility equity-market exposure. It does that by holding an underlying equity portfolio selected by the fund’s managers based on data science and fundamental research.

The ETF holds many of the stocks listed in the Nasdaq-100 index. However, it doesn’t have the same weighting as those stocks in the index. That can benefit or detract from its returns, depending on what the underlying holdings did in a particular period.

Leave a Comment