Annaly Capital Management (NYSE: NLY) offers an alluring dividend. At over 13%, its yield is 10 times higher than the S&P 500‘s. With that higher reward potential comes a higher risk profile.

That risk is apparent when taking a closer look at the mortgage REIT’s third-quarter results. Here’s the key number that puts its high-yielding dividend at a high risk for another reduction.

Annaly Capital Management reported $0.66 per share of earnings available for distribution (EAD) during the third quarter, which is money it could pay out in dividends. That was only slightly above its quarterly dividend payment of $0.65 per share. Its EAD was flat with the year-ago period and down from $0.68 per share in the second quarter.

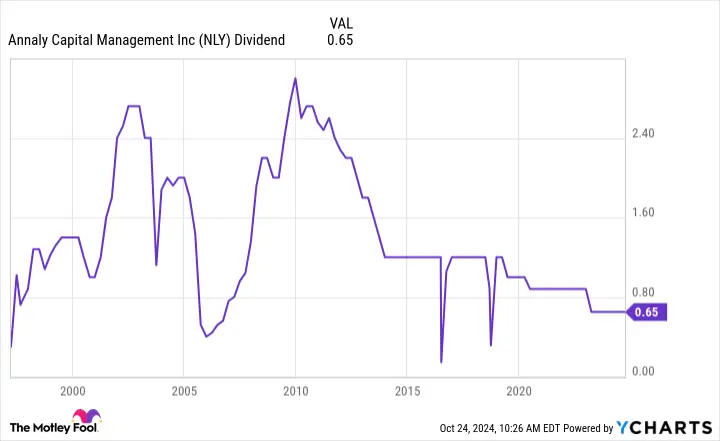

On the one hand, Annaly is currently earning more than its dividend. However, its EAD has fallen steadily over the years, which has led the company to make a series of dividend cuts.

For example, its EAD fell from $0.89 per share at the end of 2022 to $0.81 during the first quarter of 2023. That decline led the REIT to reduce its dividend payment from $0.88 per share to its current level of $0.65. That was one of the many dividend cuts the company has made over the years:

If Annaly’s EAD falls any further, the REIT would likely need to reset its dividend to a lower level again.

While its EAD has fallen precariously close to its current dividend level, some positives suggest that the company might be able to maintain its payout in the coming quarters. For example, the REIT earned enough money to cover its dividend even though it employed less leverage during the quarter. Its economic leverage ratio was 5.7 times, down from 5.8 last quarter and 6.4 in the year-ago period.

Meanwhile, the market conditions for agency mortgage-backed securities (MBS) — pools of mortgages protected from credit risk by government agencies like Fannie Mae — are improving. Annaly CEO David Finkelstein said in the earnings press release, “Agency MBS benefited from the onset of the Federal Reserve’s rate cutting cycle.”

Because of that, he said, the REIT was “able to deploy equity capital raised during the quarter into the sector, given attractive new money returns.” That positions it to make more money.

The CEO also said that “our whole loan correspondent channel continues to generate record production with exceptional credit quality, and our differentiated MSR [mortgage servicing rights] portfolio has consistently performed ahead of expectations.”

Leave a Comment