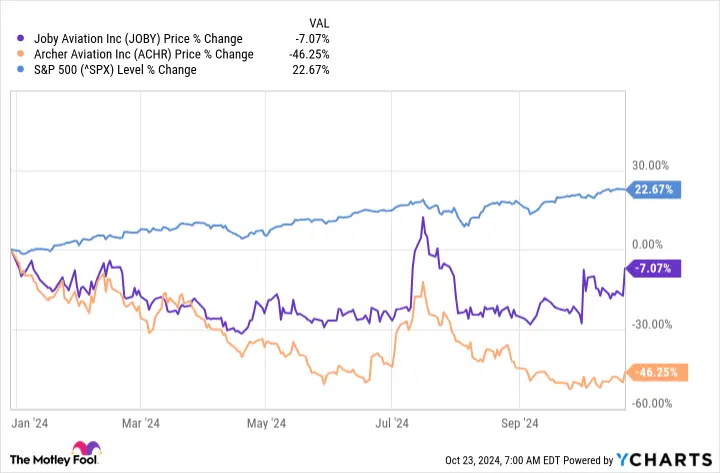

This week, the race to dominate urban air transportation hit a major milestone when U.S. aviation regulators released final safety rules for electric vertical takeoff and landing (eVTOL) aircraft. The news lifted shares of both Joby Aviation (NYSE: JOBY) and Archer Aviation (NYSE: ACHR), two leading eVTOL developers in the U.S., though both stocks have lagged the benchmark S&P 500 in 2024 by a wide margin.

The prize at stake in this emerging industry could be extraordinary. Analysts at the investment bank Morgan Stanley project the global urban air mobility market to reach $1 trillion by 2040, as electric air taxis promise to transform how people move through congested cities.

Let’s examine the core value propositions of these two pioneering companies to determine which stock is the better buy right now.

Toyota Motor Corporation (NYSE: TM) just poured another $500 million into Joby Aviation, bringing its total investment to $894 million. The Japanese auto giant will own over 20% of Joby once the second part of this investment tranche is funded in 2025.

Best of all, this landmark partnership extends far beyond capital investment. Toyota’s engineers are also working alongside Joby’s team in California to streamline manufacturing processes and scale production. That’s a big feather in Joby’s cap, one that could give the company an important competitive edge in the fiercely competitive eVTOL race.

Joby isn’t just focusing on the U.S. market. The company has also inked deals with Dubai’s Road and Transport Authority and Abu Dhabi’s government departments.

On the financial front, Joby’s $825 million in cash and short-term investments at the end of the second quarter provide significant operating flexibility as the company pushes toward commercialization. The air taxi pioneer has also completed an impressive 37% of stage four certification requirements and expects to accelerate this process through the remainder of 2024.

Archer Aviation has completed over 400 test flights this year for its aircraft Midnight, hitting this key operating goal four months ahead of schedule. The intensive testing program spans transition flights, high-rate operations, and landing profiles across various conditions.

This impressive operational progress is matched by the company’s growing financial strength. In August, Archer announced the closing of $220 million of a planned $230 million capital raise, backed by transportation heavyweights United Airlines and Stellantis.

Leave a Comment