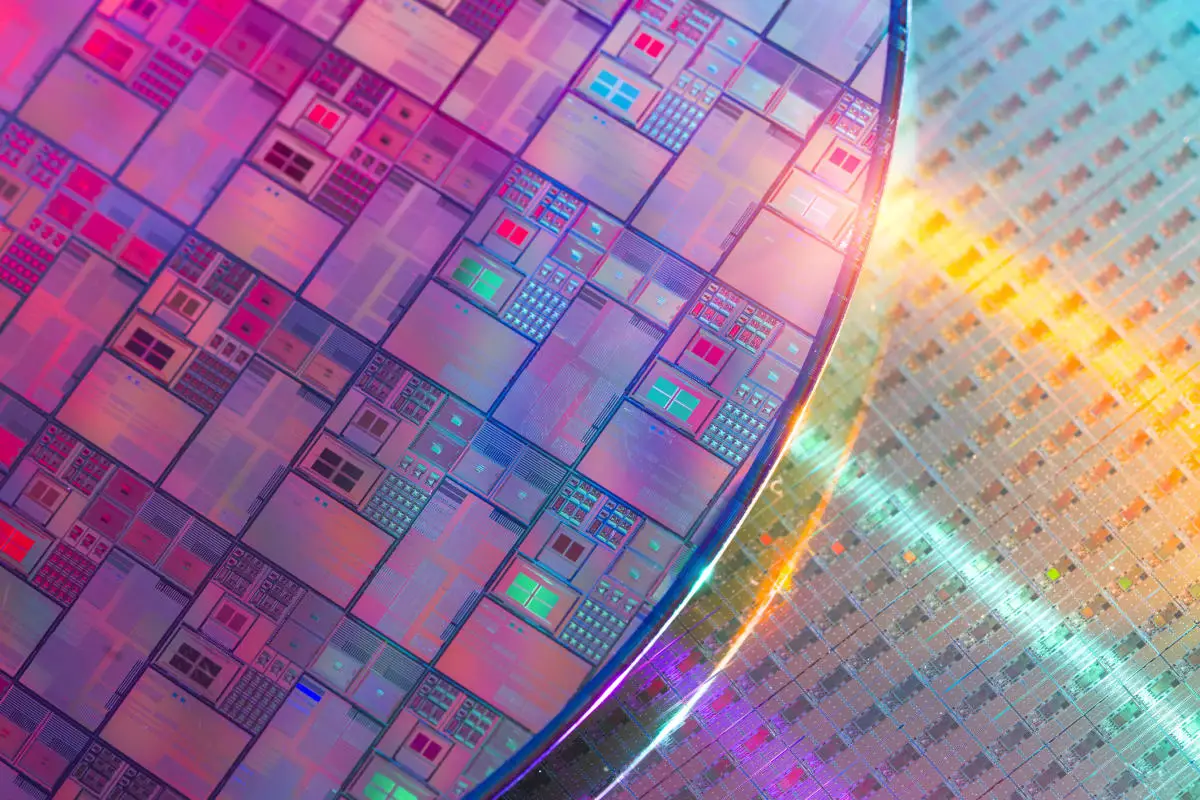

The rise of Broadcom (NASDAQ: AVGO) seemed to come out of nowhere. Amid the stock’s rise, Broadcom’s market cap now exceeds $800 billion, making it the 11th-largest company trading on the U.S. market.

Still, this is not among the top stocks in the semiconductor and software industries, as the average consumer has little direct contact with its products. Hence, the question for investors is how they might have missed this stock and whether it is too late to capitalize on its growth.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Investors should understand that next to ASML, Broadcom is probably one of the harder semiconductor stocks to notice.

For one, it exclusively targets other businesses as customers throughout its history. It succeeded by employing engineers near the headquarters of its customers. This allowed it to collaboratively develop chips that met its customer’s needs. But while products such as the Wi-Fi hotspot on Apple‘s iPhone made it into the consumer space, most of this happened away from the eyes of investors.

Moreover, it expanded into infrastructure software beginning in 2018. This insulated the company from the cyclical nature of the chip industry while allowing it to offer combined hardware and software applications.

Additionally, this infrastructure software segment received a tremendous boost after Broadcom acquired VMWare in 2023. Consequently, it now constitutes 44% of the company’s total revenue.

However, like on the hardware side, it serves business customers. Thus, it was easy to escape the notice of investors not directly involved in the tech industry.

The other factor was the name changes. The company began as Avago Technologies. The Broadcom name may sound familiar because it was the moniker of a company that made chips for wireless and broadband applications. Avago bought this company in 2016 and adopted the Broadcom name.

Investors who don’t own Broadcom stock have missed out on a reliable dividend. Its payout has risen every year since 2010. Its annual payout of $2.12 per share has a dividend yield of 1.2%, below the S&P 500‘s yield of 1.25%. Still, it has risen by double digits annually almost every year of the company’s existence, making it a significant portion of the total returns for long-term investors.

Moreover, the 280% increase in Broadcom stock over the last two years took a toll on dividend yields. Its recovery from the 2022 bear market accelerated in early 2023 as its role in generative AI became more apparent.

Leave a Comment