As you near retirement, one of the more important decisions you will make is when to claim Social Security benefits. It’s a decision that will affect how much you receive monthly, so you don’t want to just gloss over it, like people tend to do with terms and conditions.

The earliest you can claim Social Security benefits is 62, but doing so could reduce your monthly benefit by up to 30% (for those whose full retirement age is 67). That said, many people would rather have lower monthly benefits for a longer period than higher monthly benefits for a shorter period.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

If you’re considering claiming Social Security at 62, knowing the average monthly benefit could help give you an idea of what you could expect to receive.

Here are the averages by sex for those claiming at 62:

|

Sex |

Average Monthly Social Security Benefit |

|---|---|

|

All |

$1,275 |

|

Men |

$1,421 |

|

Women |

$1,141 |

Data source: Social Security Administration. Benefits rounded to the nearest dollar.

The discrepancy between average monthly benefits between men and women generally comes down to the difference in lifetime earnings, leading to our next point.

How much you receive in Social Security benefits comes down to your earnings through your career and how much you’ve paid in Social Security taxes.

Social Security looks at the 35 years when you earned the most money, adjusts the amounts to put them into today’s dollar value (called “indexing”), and then divides the total number of months in those 35 years to get your average indexed monthly earnings (AIME).

For people without 35 years’ worth of earnings, Social Security will use zeros for the missing years to calculate your AIME.

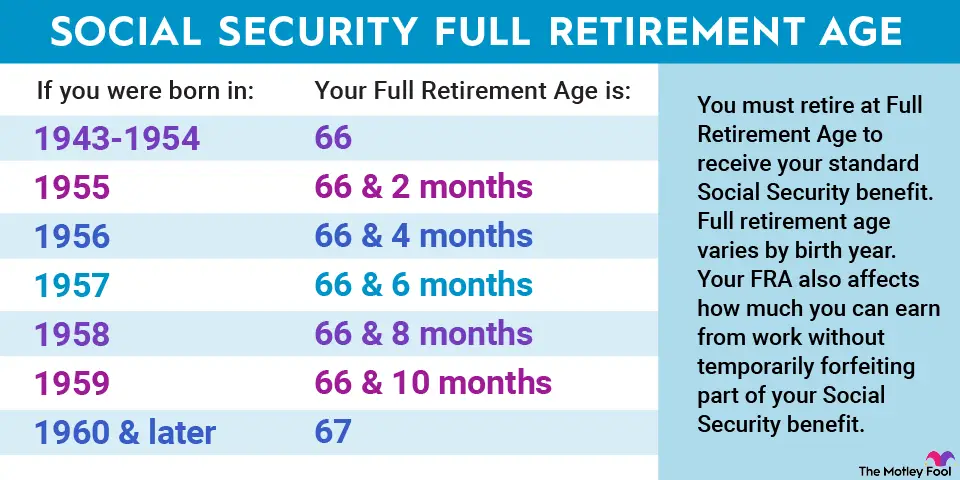

Once Social Security figures out your AIME, they’ll apply a formula using bend points to determine your primary insurance amount (PIA). This is the monthly benefit you’ll receive at your full retirement age, which is based on birth years, as shown in the graphic.

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

Leave a Comment