Buying a top growth stock on weakness can result in fantastic gains for long-term investors. The key is to understand why a stock may be struggling. If it’s due to market or industry-related factors, and the underlying business remains in solid shape, it can be an optimal time to invest in a struggling stock.

One growth stock that’s been under pressure in recent months is e.l.f. Beauty (NYSE: ELF). Although the company has been posting strong results, it’s stock down around 50% from its 52-week high of $221.83.

Is this an example of a good growth stock to buy on the dip or are there real problems at e.l.f. that should prevent you from investing in the business?

Shares of e.l.f. began nosediving in early August after the company released its earnings numbers. Growth was good for the cosmetics company but wasn’t impressive enough due to rising expenses and tepid guidance.

The business generated strong 50% revenue growth, with its top line rising to $324.5 million for the June quarter, but net income declined by more than 10% as the company incurred higher costs. For fiscal 2025, which ends in March, e.l.f. is projecting net sales of around $1.29 billion, which would represent an increase of approximately 26%, compared to the previous year. That’s a sizable slowdown in the business and may have spooked investors expecting a more gradual decline in the growth rate.

A stock that’s trading at an inflated valuation can create expectations of high continued growth. When that doesn’t happen, a correction can follow.

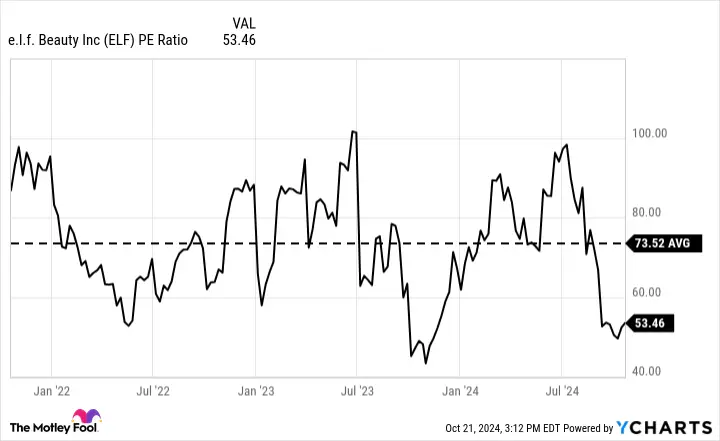

Due to e.l.f. Beauty’s impressive and continued growth over the years, investors have been eagerly buying up shares of the company, sending its valuation soaring. Despite the big drop in price recently, the stock is still trading at more than 50x trailing earnings. The positive spin is that this is significantly lower than what the stock has averaged over the past few years.

You can look at this and see a stock that’s been trading at a high premium for a long time and was overdue for a sell-off, or a cheap stock worth buying at this reduced valuation. Some high-powered growth stocks can sustain high valuations, even at more than 50x or 60x earnings, due to their strong outlooks.

Analysts appear to think that e.l.f. stock can recover, as the consensus analyst price target is more than $186, implying an upside of 65% for investors who buy the stock today.

A slowdown in e.l.f.’s business may have been inevitable, given the headwinds the economy is facing these days, and that it’s difficult to maintain such a high growth rate for long. However, the need for low-cost beauty products still presents the business with an attractive long-term growth opportunity. And e.l.f. has been growing its profits over the years. As the company continues to scale, its earnings numbers should improve, paving the way for a better valuation in the future.

Leave a Comment