Nvidia (NASDAQ: NVDA) remains one of the hottest artificial intelligence (AI) stocks on the market. But did you know that the company also pays a dividend? And something strange happened to that dividend earlier this year.

Many profitable companies that experience rapid growth in their sales opt to boost their dividend payments over time. At first glance, the opposite seems true for Nvidia.

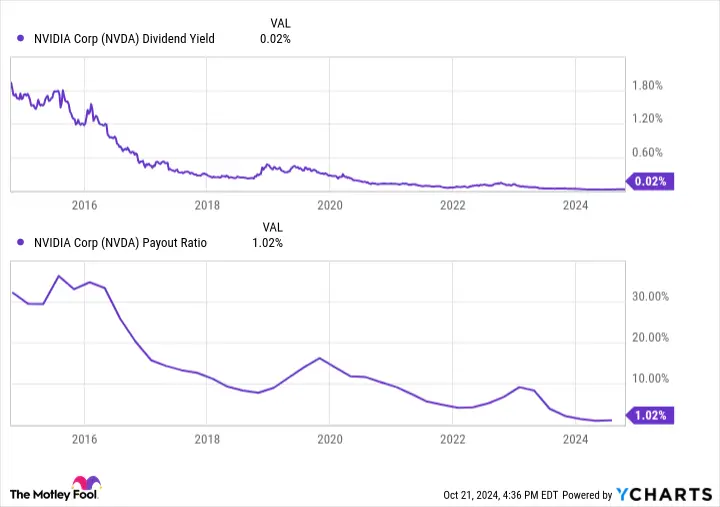

In 2020, the company was paying a quarterly dividend of $0.16 per share. In 2021, the quarterly payout was lowered to $0.04 per share. And then, in early 2024, it was lowered again to just $0.01 per share per quarter. All of this has brought Nvidia’s dividend yield down to just 0.02%, with a payout ratio of merely 1% of Nvidia’s bottom-line earnings.

But these numbers don’t reflect the company’s stock splits, which can artificially disguise a rising dividend. Earlier this year, for example, the company enacted a 10-for-1 stock split. Adjusted for this stock split, the current $0.01-per-share quarterly dividend is really equivalent to $0.10 per share on a pre-split basis — more than double the previous dividend payout. The same was also true in 2020, when the company split its shares 4 for 1.

Of course, Nvidia isn’t struggling financially. Since 2020, shares have risen in value by more than 1,000%, buoyed by a massive surge in demand for AI GPUs — a segment of the market in which Nvidia maintains a market share of 70% to 95%. Profits have skyrocketed due to this demand. So while the dividend rate actually has been rising when adjusting for stock splits, it has been completely overshadowed by an even bigger increase in earnings, causing the payout ratio to fall dramatically.

In summary, Nvidia very much remains a growth stock, not an income stock. But don’t let the top-line numbers fool you — Nvidia continues to up its dividend rate, a reality somewhat masked by massive stock splits.

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $855,238!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

Leave a Comment